Gratuity is a key benefit for employees in the United Arab Emirates (UAE). It’s a payment from your employer when your job ends, provided you’ve worked for at least one year. This payment, also called end-of-service benefits, is based on your basic salary and how long you’ve worked. Calculating gratuity correctly is important for financial planning, but it can be complex due to varying contract types and rules.

This guide explains gratuity in the UAE, how to calculate it, and why using an online gratuity calculator updated with 2025 regulations from the Ministry of Human Resources and Emiratisation (MOHRE) is the best approach. We’ll also cover new end-of-service schemes, tips to maximize your gratuity, and what to do if there’s a dispute.

What is Gratuity in the UAE?

Gratuity is a mandatory payment employers make to employees when their employment ends, as outlined in Article 51 of the UAE Labour Law. It’s a reward for your service and applies to expatriates and, in some cases, UAE citizens in the private sector.

Key Points:

Exclusions: You may not receive gratuity if you resign without serving the notice period or are dismissed for misconduct, such as theft or violence.

Eligibility: You must work at least one year to qualify.

Basis: Gratuity is calculated using your basic salary, excluding allowances, bonuses, or other benefits.

Contract Types: Rules differ for limited (fixed-term) and unlimited (open-ended) contracts.

How is Gratuity Calculated in the UAE?

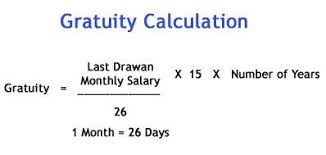

Gratuity calculations depend on your contract type, basic salary, years of service, and reason for leaving (resignation or termination). Below are the formulas based on the UAE Labour Law, updated for 2025.

For Unlimited Contracts:

- 1 to 5 Years of Service:

Gratuity = Basic Salary × 21 × Number of Years Served - More Than 5 Years of Service:

Gratuity = (Basic Salary × 21 × 5) + (Basic Salary × 30 × (Years of Service – 5))

For Limited Contracts:

- If Contract is Completed:

Same as unlimited contracts (use the formulas above). - If Leaving Early:

No gratuity is typically paid unless the employer agrees otherwise.

Important Notes:

- Basic Salary: Only your basic salary is used, not allowances or bonuses.

- Service Period: Days of unpaid leave are excluded from the service period.

- Payment Deadline: Employers must pay gratuity within 14 days of contract termination, per the UAE Labour Law.

Table: Gratuity Calculation Examples

| Scenario | Contract Type | Basic Salary (AED) | Years of Service | Gratuity Amount (AED) |

|---|---|---|---|---|

| Resignation after 3 years | Unlimited | 10,000 | 3 | 10,000 × 21 × 3 = 630,000 |

| Termination after 7 years | Unlimited | 15,000 | 7 | (15,000 × 21 × 5) + (15,000 × 30 × 2) = 247,500 |

| Early exit from limited contract | Limited | 12,000 | 2 | 0 (unless employer agrees) |

Why Use an Online Gratuity Calculator?

Manual gratuity calculations can be error-prone due to complex formulas and varying rules. Online gratuity calculators simplify the process by providing accurate results based on 2025 MOHRE regulations.

How to Use an Online Gratuity Calculator:

- Select Contract Type: Choose a limited or unlimited contract.

- Enter Basic Salary: Input your basic salary (excluding allowances).

- Add Service Duration: Specify years and months worked.

- Choose Reason for Leaving: Indicate resignation or termination.

- Calculate: Get an instant gratuity estimate.

Popular Online Gratuity Calculators:

- Gratuity Calculator UAE: A dedicated tool for UAE gratuity calculations.

- Gulf News Gratuity Calculator: A trusted option from a reputable UAE news source.

- Zoho Payroll Gratuity Calculator: Part of Zoho’s payroll software, ideal for employees and employers.

Conditions for Receiving Gratuity

To receive gratuity, you must meet specific conditions under the UAE Labour Law.

Eligibility Criteria:

- Complete at least one year of continuous service.

- Serve the required notice period if resigning.

- Avoid dismissal for misconduct (e.g., theft, violence).

- For limited contracts, complete the full contract term (unless the employer waives this).

Exceptions:

- Domestic workers (e.g., housemaids) have a different gratuity formula: one month’s salary per year of service after one year.

- Contract terms or UAE labor law can deny your gratuity.

New End-of-Service Benefits Schemes for UAE Citizens

Recently, MOHRE introduced optional end-of-service benefits schemes for UAE citizens in the private sector. These schemes aim to provide better financial security and may replace or supplement traditional gratuity.

Key Features:

- Optional for Employers: Employers can register with MOHRE to participate.

- Fund-Based System: Employers make monthly contributions to a growing fund over time.

- Benefits for UAE Citizens: This system offers potentially higher payouts compared to traditional gratuity.

Comparison with Traditional Gratuity:

- Traditional Gratuity: A lump-sum payment based on basic salary and service years.

- New Schemes: A savings fund with contributions and potential returns, similar to a pension.

Table: Traditional Gratuity vs. New Schemes

| Feature | Traditional Gratuity | New End-of-Service Schemes |

|---|---|---|

| Payment Type | Lump sum | Fund-based with returns |

| Eligibility | Expatriates and UAE citizens | UAE citizens (optional) |

| Calculation | Based on basic salary and years | Based on contributions and fund growth |

| Employer Role | Pays at termination | Contributes monthly |

Note: Verify if your employer has enrolled in these schemes.

Tips to Maximize Your Gratuity

While fixed formulas calculate your gratuity, you can take steps to ensure you receive the maximum amount.

Tips:

- Know Your Contract: Understand whether you have a limited or unlimited contract and its impact on gratuity.

- Track Service Period: Keep records of your employment duration, including any unpaid leave.

- Verify Basic Salary: Make sure to accurately document your basic salary, as it serves as the foundation for your gratuity.

- Plan Your Exit: Time your resignation to maximize service years, if possible.

- Seek Legal Advice: Consult MOHRE or a legal expert if you suspect errors in your gratuity calculation.

What to Do If There’s a Gratuity Dispute

Disputes over gratuity can occur due to miscalculations or disagreements. Here’s how to handle them:

- Discuss with HR: Request a detailed breakdown of your gratuity calculation.

- Gather Documents: Please gather your employment contract, salary slips, and termination letter.

- Contact MOHRE: File a complaint with MOHRE for mediation.

- Legal Action: If unresolved, consider legal action through UAE courts.

Image Suggestion: Include a flowchart showing the steps to resolve a gratuity dispute.

2025 UAE Labour Law Updates

The UAE Labor Law was updated in 2023 (Federal Decree-Law No. 33 of 2021), effective from February 2022, with no major changes to gratuity calculations reported for 2025. All contracts now have a maximum duration of five years, but the gratuity formula stays the same.

- The gratuity formula remains at 21 days’ pay per year for the first five years.

- After that, you will receive 30 days’ pay per year.

Note: Always check the MOHRE website for the latest updates.

FAQ’S

Conclusion

Gratuity is a vital benefit for UAE employees, ensuring financial support after employment ends. Using an online gratuity calculator updated with 2025 MOHRE regulations ensures accuracy and saves time. For UAE citizens, new end-of-service schemes offer additional options. If disputes arise, MOHRE and legal channels can help. Stay informed about your rights under the UAE Labor Law to secure your entitled benefits.